An Unbiased View of Feie Calculator

Table of ContentsThe 8-Second Trick For Feie CalculatorFeie Calculator for Dummies7 Easy Facts About Feie Calculator ExplainedFeie Calculator for BeginnersFeie Calculator - An Overview

He offered his U.S. home to establish his intent to live abroad completely and used for a Mexican residency visa with his other half to help satisfy the Bona Fide Residency Examination. Neil directs out that buying residential or commercial property abroad can be challenging without initial experiencing the location."We'll most definitely be outdoors of that. Also if we return to the US for medical professional's visits or business phone calls, I question we'll spend more than 30 days in the United States in any offered 12-month period." Neil stresses the relevance of rigorous tracking of U.S. sees (Foreign Earned Income Exclusion). "It's something that people need to be truly attentive regarding," he states, and encourages expats to be careful of common blunders, such as overstaying in the U.S.

Fascination About Feie Calculator

tax obligation commitments. "The reason U.S. tax on around the world earnings is such a huge bargain is because lots of people forget they're still subject to U.S. tax obligation also after moving." The united state is just one of the couple of countries that taxes its citizens despite where they live, suggesting that even if a deportee has no revenue from united state

income tax return. "The Foreign Tax Credit score permits people working in high-tax nations like the UK to counter their U.S. tax obligation liability by the amount they have actually currently paid in tax obligations abroad," says Lewis. This makes certain that deportees are not taxed twice on the same earnings. Those in reduced- or no-tax countries, such as the UAE or Singapore, face additional obstacles.

Feie Calculator Can Be Fun For Everyone

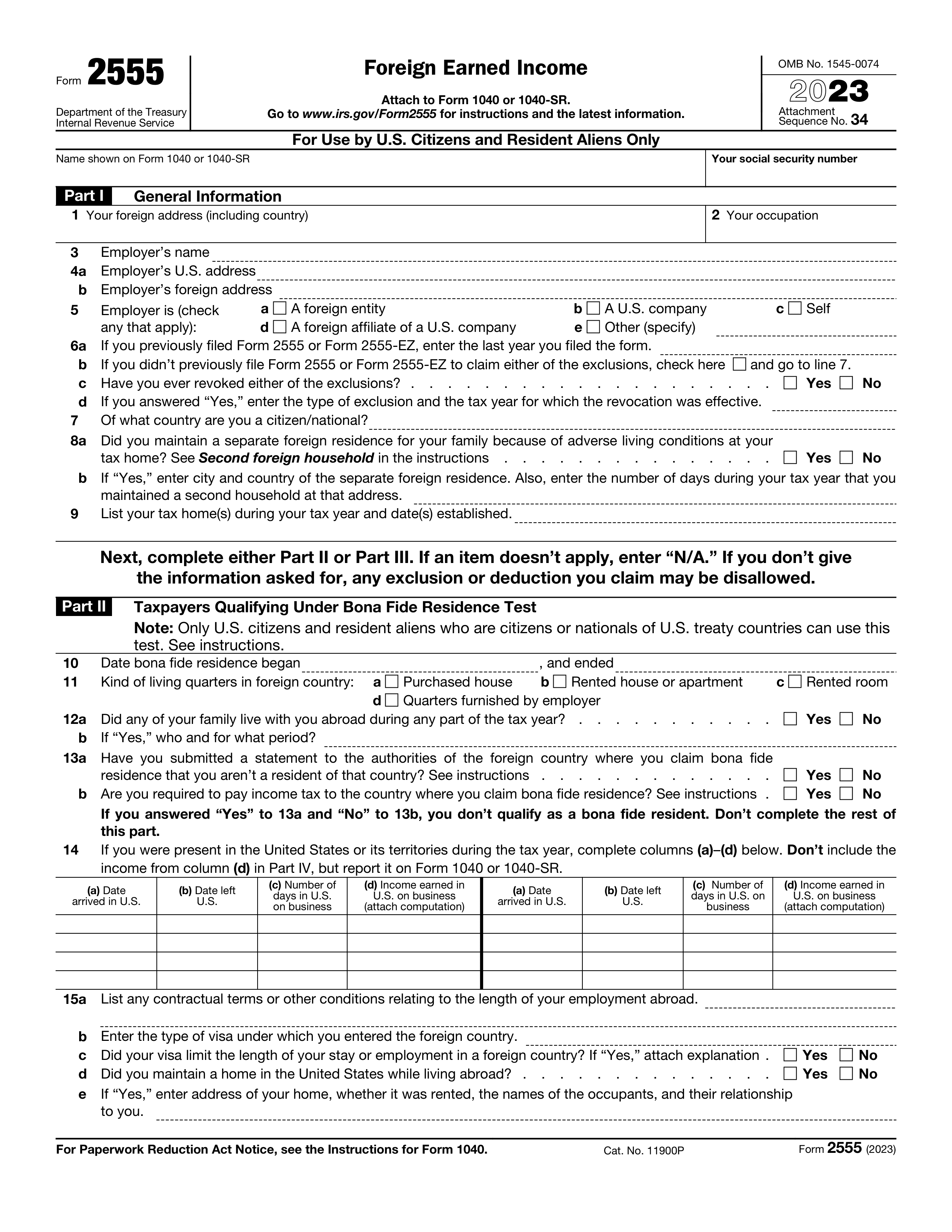

Below are a few of the most often asked inquiries concerning the FEIE and various other exclusions The International Earned Earnings Exclusion (FEIE) permits U.S. taxpayers to leave out as much as $130,000 of foreign-earned income from federal earnings tax obligation, minimizing their U.S. tax obligation responsibility. To get FEIE, you have to satisfy either the Physical Visibility Test (330 days abroad) or the Authentic Residence Test (confirm your key house in a foreign nation for an entire tax year).

The Physical Visibility Examination additionally calls for United state taxpayers to have both a foreign revenue and a foreign tax home.

The Facts About Feie Calculator Revealed

A revenue tax treaty in between the U.S. and one more country can aid avoid double taxation. While the Foreign Earned Income browse around this web-site Exemption lowers gross income, a treaty might give additional benefits for qualified taxpayers abroad. FBAR (Foreign Checking Account Record) is a called for declaring for united state citizens with over $10,000 in international monetary accounts.

Qualification for FEIE depends on meeting details residency or physical existence tests. is a tax advisor on the Harness system and the founder of Chessis Tax. He belongs to the National Association of Enrolled Representatives, the Texas Society of Enrolled Professionals, and the Texas Society of CPAs. He brings over a decade of experience benefiting Huge 4 companies, recommending migrants and high-net-worth people.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax obligation expert on the Harness system and the owner of The Tax Guy. He has more than thirty years of experience and currently specializes in CFO solutions, equity payment, copyright tax, marijuana taxes and separation related tax/financial preparation issues. He is a deportee based in Mexico - https://swaay.com/u/louisbarnes09/about/.

The international made earnings exemptions, sometimes referred to as the Sec. 911 exemptions, omit tax obligation on incomes made from working abroad.

The Single Strategy To Use For Feie Calculator

The earnings exemption is now indexed for rising cost of living. The optimal annual income exemption is $130,000 for 2025. The tax obligation advantage omits the revenue from tax at bottom tax prices. Formerly, the exclusions "came off the top" reducing earnings subject to tax on top tax prices. The exemptions may or may not minimize earnings utilized for other purposes, such as individual retirement account limitations, kid credit ratings, individual exemptions, and so on.

These exemptions do not excuse the salaries from US taxation however just provide a tax decrease. Note that a bachelor functioning abroad for all of 2025 that made concerning $145,000 without any other earnings will have taxable earnings lowered to zero - successfully the exact same answer as being "tax free." The exclusions are computed every day.